GROW MEMBERSHIP VIDEO LIBRARY

200 SERIES: Estate Management Strategies

200 SERIES: ESTATE MANAGEMENT STRATEGIES

200 – Understanding Potential Estate Losses

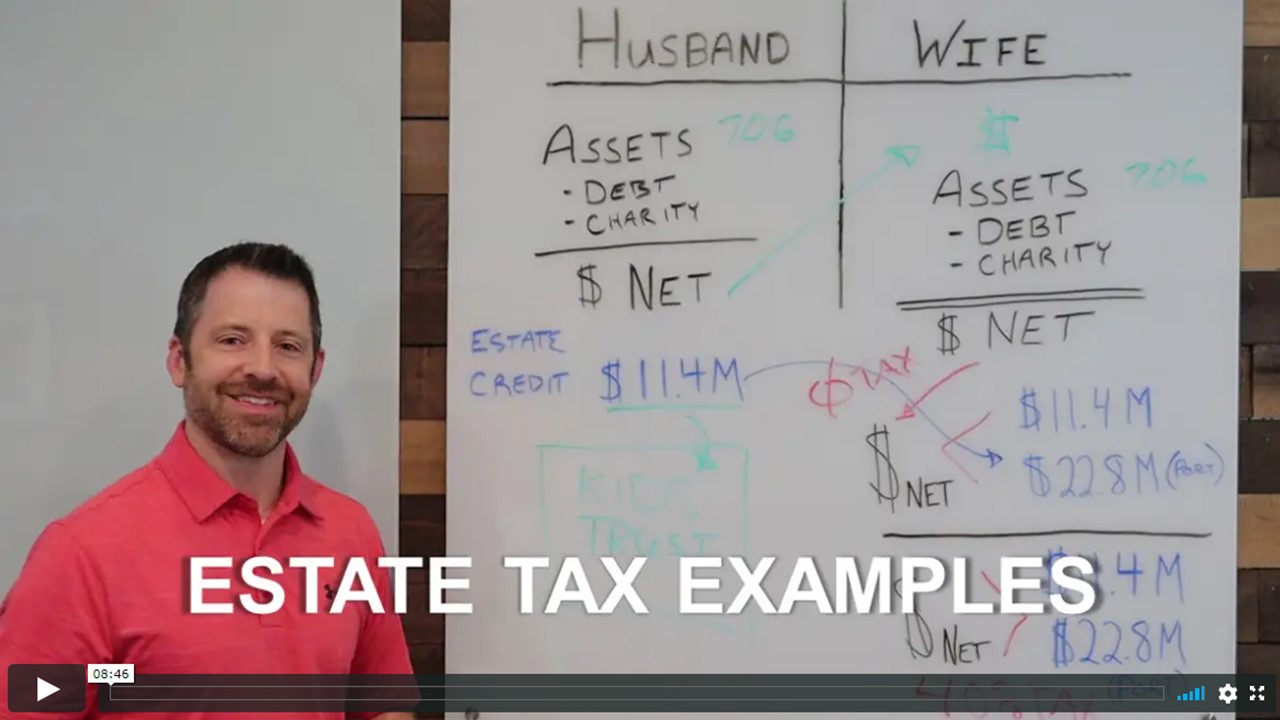

201 - Federal Estate Tax Examples

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- Comparisons of estate tax consequences upon the first and second death.

- Examples of estate tax implications for married couples, widows, individuals, trusts established upon first death, and second marriages.

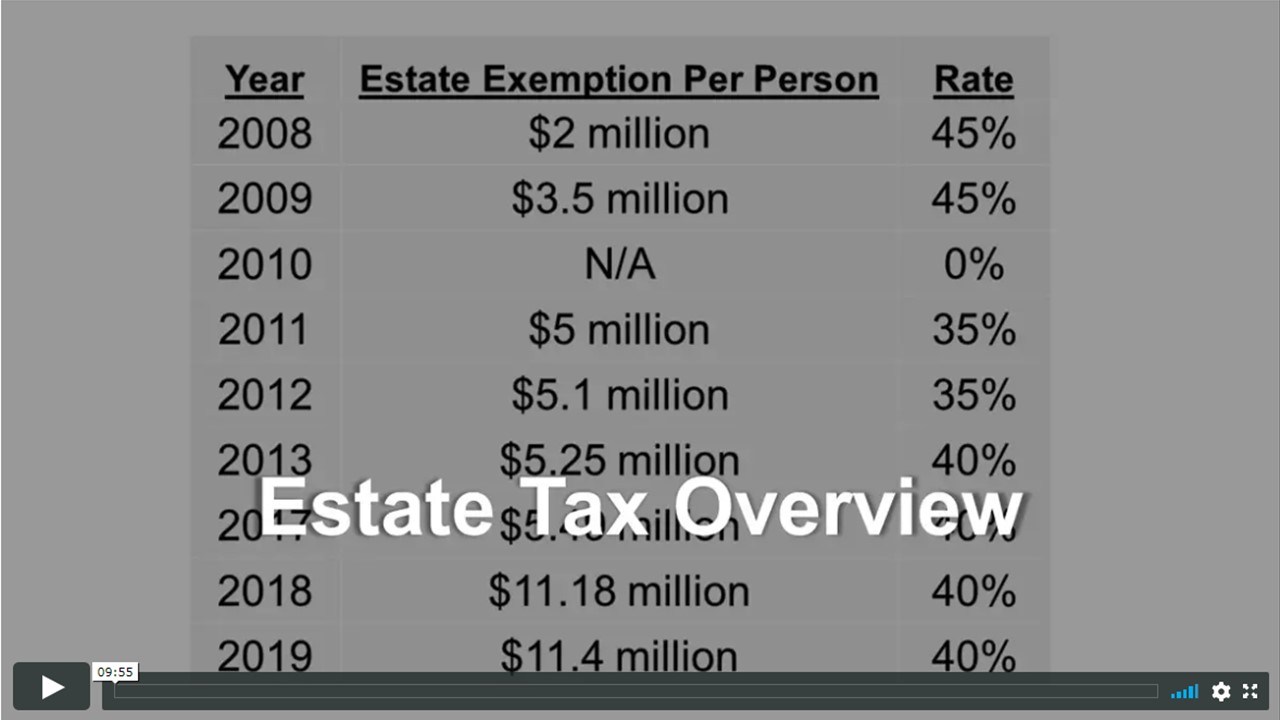

202 - Federal Estate Tax Overview

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- History of the federal estate tax.

- Federal vs State estate tax.

- Estate Tax vs Gift Tax.

- Current estate tax limits.

203 - Probate (VIDEO COMING SOON!)

TOPICS COVERED IN UPCOMING VIDEO FOR GROW MEMBERS:

- How probate works.

- Typical costs of the probate process.

- What happens when you own real estate in two or more states.

204 - Capital Gains (VIDEO COMING SOON!)

TOPICS COVERED IN UPCOMING VIDEO FOR GROW MEMBERS:

- How capital gains tax applies to farm assets.

- Current federal capital gain tax rate.

- Stepped up basis.

205 - Inheritance Tax (VIDEO COMING SOON!)

TOPICS COVERED IN UPCOMING VIDEO FOR GROW MEMBERS:

- Overview of Inheritance tax vs. estate tax.

- Understanding when an inheritance tax might apply.

- Assets classes that are not subject to an inheritance tax.

210 – Estate Management Tools

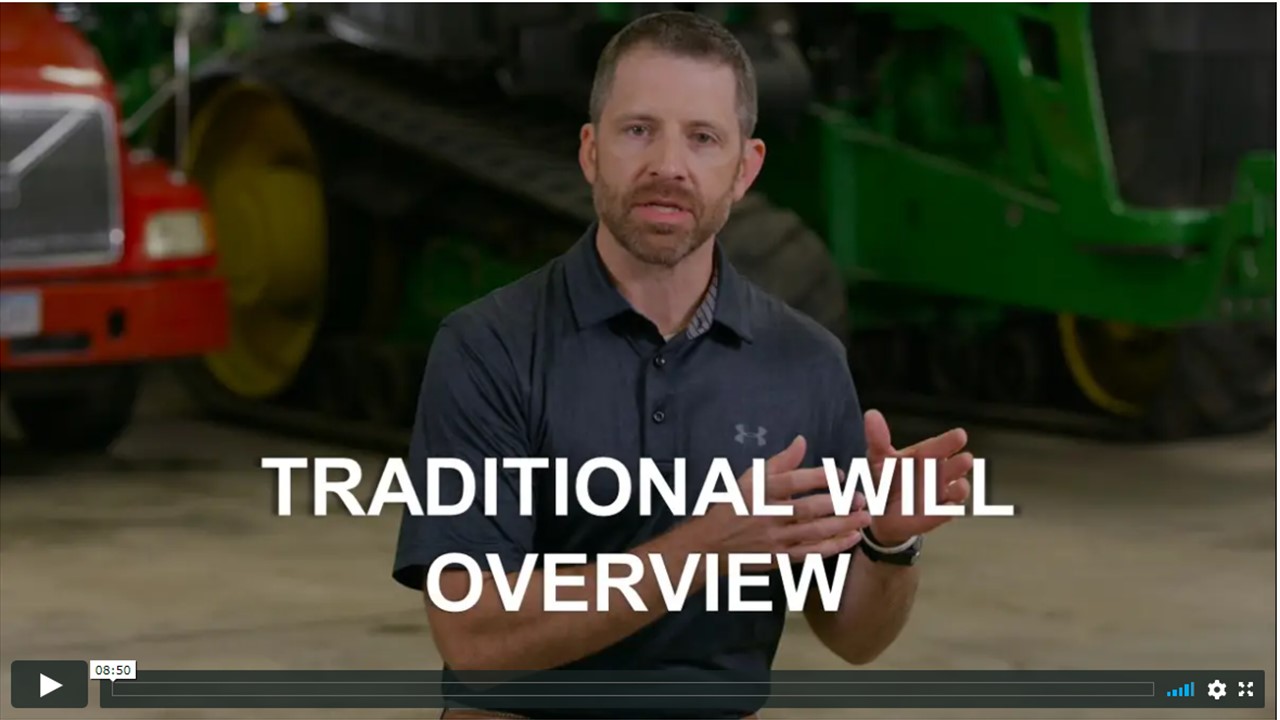

211 - Traditional Will Overview

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- How a will works.

- Role of the personal representatives (executor, trustees, guardians, etc.)

- Asset classes that do not go through a will

212 - Revocable Trusts (VIDEO COMING SOON!)

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- Purpose of a revocable trust.

- What a revocable trust does and does not do.

- The pitfalls of not coordinating your revocable trust with your asset ownership and beneficiary designations.

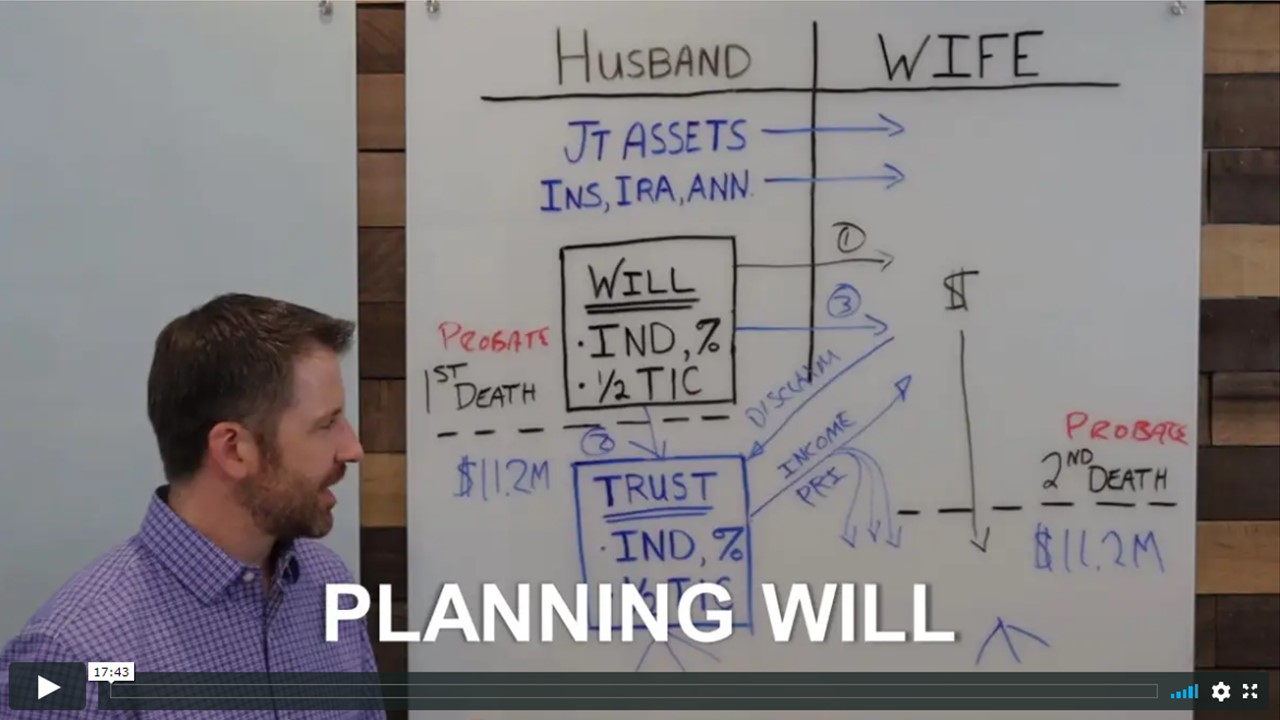

213 - Planning Will with Trust Set Up at 1st Death

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- Advantages of

a planning will vs. a simple will - Pro’s and Con’s of

a planning will vs. a revocable trust. - Why you might want to consider a trust set up after first death even if you don’t have estate tax concerns.

- Cost basis adjustment at the first vs. second death.

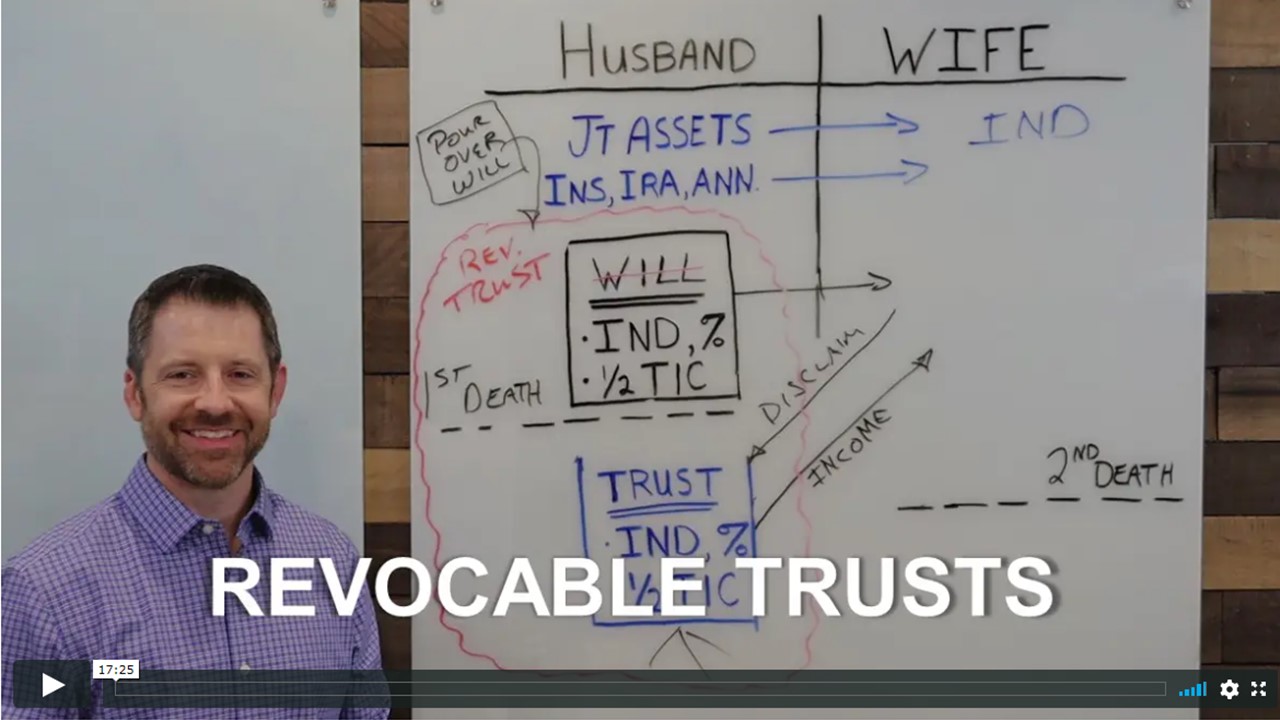

214 - Revocable Trust with Credit Shelter Trust at 1st Death

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- White board example of how a revocable trust works.

- Pro’s and con’s of a revocable trust vs. a planning will.

- Why you might want to consider retaining assets in trust after the first death even if there isn’t an estate tax concern.

- Cost basis adjustment at first vs. second death.

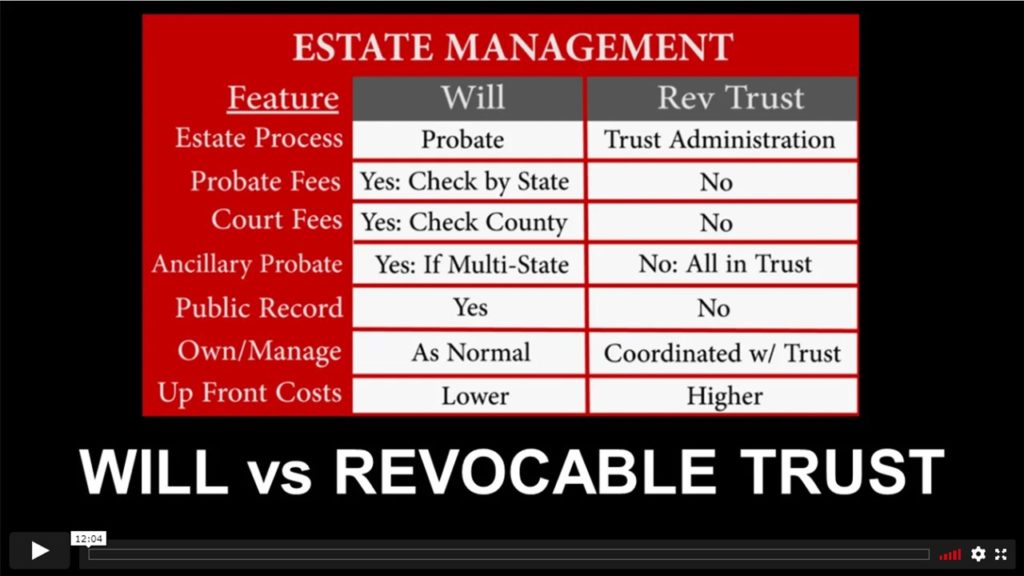

215 - Traditional Will vs Revocable Trust

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- A side-by-side comparison illustrating the pros and cons of each strategy.

- Differences of who has control while living, incapacitation, and after death.

- Impacts of probate under a will vs a revocable trust.

- Key steps that often get overlooked when considering a revocable trust over a will.

216 - Portability

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- What “Portability” means, and why it is such a powerful planning option

- How Portability has completely changed traditional estate planning methods

- The four risks of passing all assets to the surviving spouse

- How to avoid missing out on the ability to “port” the federal credit between spouses

217 - Irrevocable Trust (VIDEO COMING SOON!)

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- How an irrevocable trust works.

- Why and when to use it in an estate strategy.

- Pro’s and Con’s to using an irrevocable trust.

- How to avoid the most common mistakes of an irrevocable trust in coordinating your farm succession strategies.

218 - Power of Attorney - Financial (VIDEO COMING SOON!)

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- How a financial power of attorney works.

- Assets that are covered under a financial power of attorney, and those that are not.

- Responsibilities of the named agent.

- Key considerations for farm management within your power of attorney.

220 – Asset Ownership Methods

221 - How Should We Own It? Individual / Joint / Tenants In Common / Entity

TOPICS COVERED IN THIS VIDEO FOR GROW MEMBERS:

- Understand the differences between ownership methods.

- Pro’s and con’s of each method of ownership.

- Learn the impact of estate distribution under each method.

- How to coordinate ownership with your estate and farm succession strategies.

222 - Revocable Trust Ownership

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- Why coordinating trust ownership is so importantt.

- Simple examples of what to own inside your revocable trust.

- What assets can be owned outside your revocable trust.

- How to get around revocable trust ownership on certain assets.

- Why you may want to set up your trust as a beneficiary of non-trust assets.

223 - Life Insurance (VIDEO COMING SOON!)

TOPICS COVERED IN UPCOMING VIDEO FOR GROW MEMBERS:

- Learn the different way to own a life insurance policy (individual, spouse, kids, trust, entity, etc.).

- Review the pro’s and con’s of each ownership method.

- Why cross-ownership between spouses is not really necessary.

- The insured/owner/beneficiary combination you definitely want to avoid!

- How to coordinate ownership & beneficiaries to fit your estate and farm succession strategy.

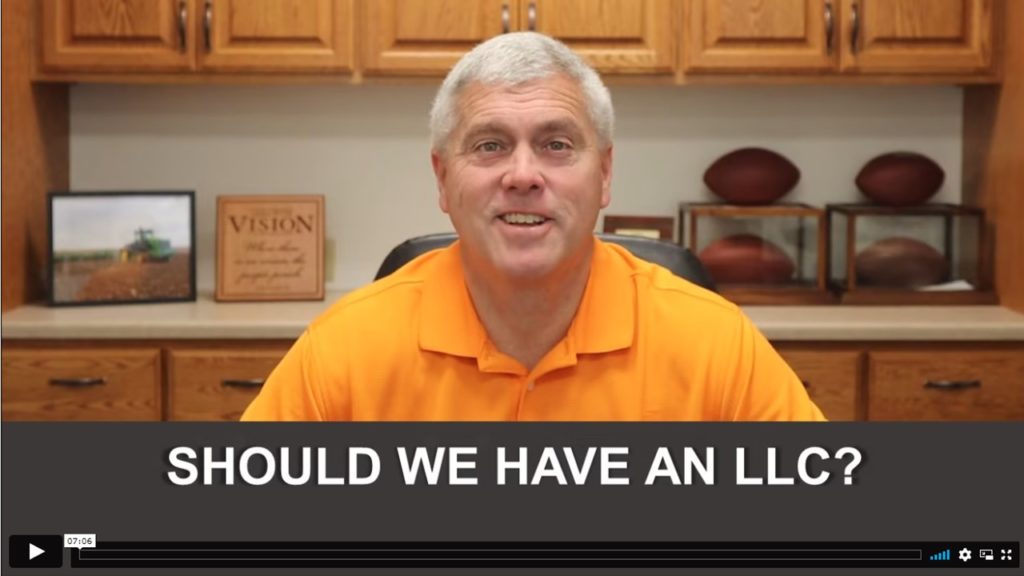

224 - Should We Have an LLC?

TOPICS COVERED IN THIS VIDEO FOR GROW MEMBERS:

- Defining what an LLC is and what it can do.

- Why you might consider an LLC in your plan.

- What assets should go into an LLC.

- Designing the exit strategy for your LLC.

- Coordinating an LLC with your farm succession strategy.

230 – Estate Reduction Tools

231 - Special Use Valuation 2032a

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- What Special Use Valuation (Section 2032a) is and why it came to be.

- How to set yourself up to qualify for Special Use Valuation.

- How to calculate Special Use Valuation

- Sample illustration of Special Use Valuation used in an estate reduction.

232 - Gifting Limits While Living

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

TOPICS COVERED IN VIDEO FOR GROW MEMBERS:

- Annual gifting limits

- When to apply a 709 gift tax return

- Lifetime exclusion amount

- Pro’s and con’s to gifting while living to reduce an estate

233 - Assets to Own Outside Your Estate (VIDEO COMING SOON!)

TOPICS COVERED IN UPCOMING VIDEO FOR GROW MEMBERS:

- Learn the asset classes that are most effective to own outside of your estate to reduce potential estate tax liability.

- Pro’s and con’s of owning assets out of your estate.

- How to avoid some of the pitfalls of owning assets outside of your estate.

234 - Discounted Valuation on Estate Assets (VIDEO COMING SOON!)

TOPICS COVERED IN UPCOMING VIDEO FOR GROW MEMBERS:

- Understand the different methods for discounting estate assets.

- Why discounted valuations of some assets are allowed.

- Why/How discounts were challenged in the past.

- How to incorporate discounted valuations to your estate or gifting strategies.

SERIES 200 VIDEOS

Which is better, a traditional will or a revocable trust? I own my land with my spouse, but not sure if it’s joint tenancy or tenants in common. Which way were we supposed to own it? Should we form an entity?

To the frustration of many, often times the answer to these questions is “Well, it depends!”. What are you trying to accomplish? There are pro and con to every strategy. You need to understand them to make informed decisions on your estate. In the 200 Series videos, we get into the nuts and bolts of the primary estate tools and how to coordinate them with your asset ownership to pass on the maximum value to your heirs.

More videos will be added regularly!

In this Series you will:

Understand the potential expenses that can reduce the value of an estate prior to distribution. Understand the pro’s and con’s of a traditional will vs. a revocable trust and when each one may apply best. See how today’s “Portability” has changed the approach to the traditional estate planning of the past. Learn how capital gains may impact your estate decisions for directing assets upon the first vs second death. Know the technical difference between an “Estate Tax” vs. an “Inheritance Tax” and why few are affected by one vs. the other. Understand the different ways of owning real assets and the impact it has on your estate distribution. Learn how to avoid the pitfalls of uncoordinated asset ownership with your estate strategies. Learn multiple ways to reduce estate value when estate taxes are a concern.

Learn the strategies that grow farms and keep peace between generations.

Join the GPS GROW Membership Today!